Silicon Alley: Powered by Brooklyn

September 12, 2008

Silicon Alley is generally thought of to be the area in Manhattan between Union Square and expanding somewhat north of Flatiron building. But in my experience the talent and creativity that feeds the New York web startup scene is largely focused in Brooklyn. It’s nothing new that Brooklynites have exhibited ambition and aspirations, but Brooklyn is in the midst of a Renaissance. It’s culturally vibrant and neighborhoods recently reminiscent of demilitarized zones have become trendy and upscale. More often than not, when my neighbors talk of leaving (or do leave) Tribeca, it’s for Brooklyn. And as I look for talented people to work with on ved.io, I often find myself crossing that famous old bridge. My co-founder in ved.io who now lives in rural Connecticut – guess where he’s from?

The Kool-Aid Business Plan

March 9, 2008

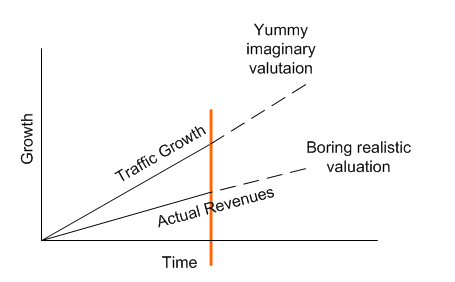

Many well respected entrepreneurs and smart VC’s argue that startups need to get to scale before wasting precious energy worrying about monetization. This creates a very tempting situation for entrepreneurs: stuff is a whole lot easier to give away than it is to sell. If the money folks aren’t expressing concern about profitability, why should I? The argument goes: what’s important is to get the business to a scale that makes monetization easy. If you don’t have scale, you’ll never have a business, so don’t even think about a business model until you have some magic number of unique visitors (1 million? 10 million?) We can see this thinking in practice too: Brightcove had better technology and a clear business model, but the relatively crappy service YouTube got the $2Bn valuation for providing a free service. Here’s how we’re supposed to look at it:

The idea is that your business won’t get to scale as quickly if you have those annoying ads or if you’re distracted by the demands of paying customers. So at any point in time (represented by the red line) if you extrapolate out actual revenues, the business looks much less interesting than if you can extrapolate from growth in non-financial metrics. Now I’m not saying that this imaginary valuation is just a fantasy. If a business model does work with your scaled-up business, you can have a real winner.

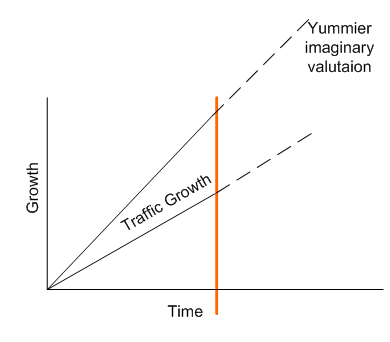

But what if that red line represents the time that the company is running out of cash? And let’s suppose that your backers were not hoping for the traffic growth you have achieved, but a steeper slope entirely:

Management may think growth is acceptable, but if the backers don’t that’s when they start changing things like strategy and leadership. Now the founders could be looking at losing control (and perhaps ownership) of the company. What I’d like to argue is that it’s just as important as you experiment with product and audience development that you experiment with the revenue generation model. Right now ved.io is an interesting technology with many promising monetization opportunities. The only thing I can say for sure about our business model is that we probably won’t get it right on the first try. The time to get creative and try things out is now, thinking of business plan, product, and audience as a three part equation; not when wild expectations aren’t met and panic sets in.

Should Every Startup Release its Product As Open Source?

January 28, 2008

I’m an entrepreneur developing a web service who is suddenly waking up to the advantages of releasing my product as open source. The recent purchase of MySQL by Sun and on a smaller scale the latest funding round for Automattic make it clear that open source can make great business sense, but as a newbie wrestling with giving away potentially valuable IP, I have questions:

- How do you mitigate the competitive risks? Making your software freely available does some wonderful things to potential competitors, but you’re telling me that my company creates revenue streams from a product that I’ve given to anyone who wants to copy my business model? What if someone with a great idea forks our code and creates a compelling competing community? How do we maintain control of the releases?

- How do you motivate, organize, and manage the community? Are there proven techniques to harness your most valuable resource?

- What kinds of applications lend themselves to open source? It’s easy to see how databases, languages and operating systems make great sense as open source since they directly benefit the developer community working on them. But what about a media platform? A UGC site? An ad supported publisher? Is there a list of criteria?

- What does the company actually own at the end of the day to make it valuable to investors? The documentation? The proprietary products you’ve built on top of the open platform? What else?

- Do I want to be a service business with 1,000 or 100,000 customers? How do you keep them all happy with low-touch support.

- Question for VCs: What percentage of your portfolio is open source and, more importantly, what would you like it to be?

- Question for anyone: What are the definitive books, blogs or other sources of information on open source business models?